The Tax Blog for Smart Canadians

Tips and tricks for Canadian tax filers at every stage of life

From UFile's tax expert Gerry Vittoratos.

Your investments, taxes and the pandemic - How to keep your cool during trying times

We find ourselves in unprecedented times with the COVID-19 pandemic.

With fear in the air, our natural instincts tell us to sell our investments and to hoard as much cash as possible. But is that a good idea? And what are the potential tax consequences of panic selling?

To sell or not to sell in a panic

Watching the stock market drop by double digits daily can be gut wrenching. Conventional wisdom would dictate that the right thing to do is to sell as quickly as possible in order to preserve your investments. But is that the best decision you can make in the long term?

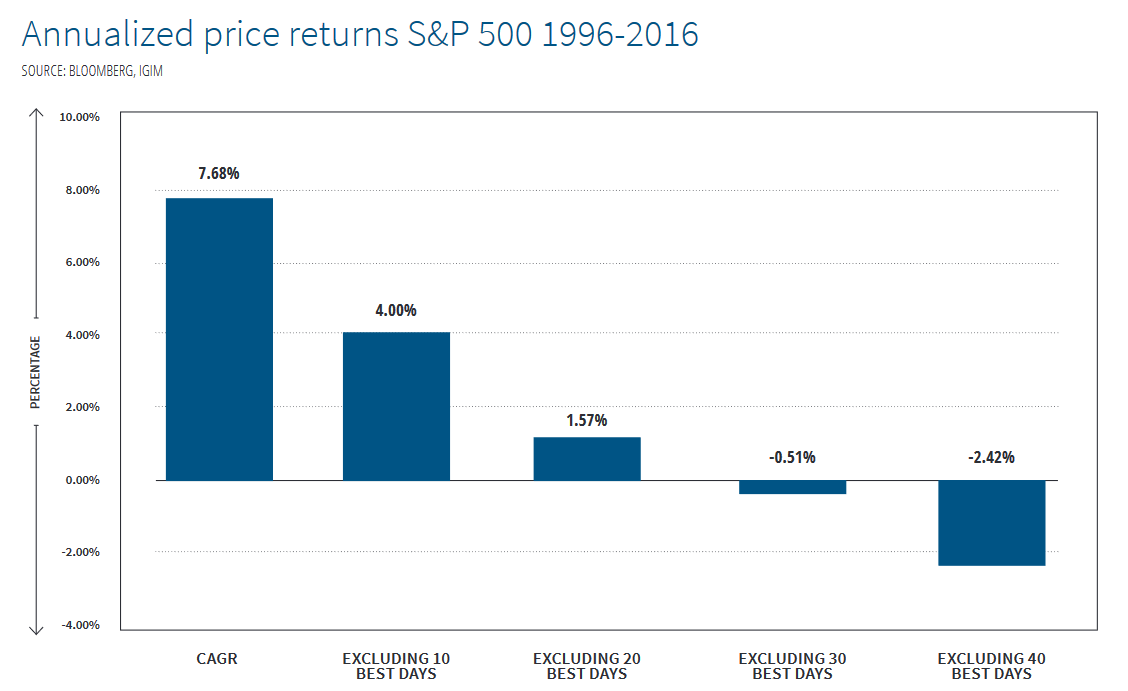

When looking at long-term historical returns of the stock market, the data shows that it pays to wait it out. One interesting statistic indicates that for the period of 1996–2016, if you missed the 20 best trading days (US S&P 500), your annualized returns dropped from 7.7% to 1.6%. This statistic includes the negative returns of bear markets such as the dotcom crash and the great recession. It’s amazing the difference a few days can make!

What these statistics reveal is that you really cannot time the market. For superior returns, your ally is time spent in the market, and not timing it.

Source: Investors Group

This article’s intent is not to offer investment advice. You should always consult a certified financial advisor before making any decisions. The statistics presented above should give you “food for thought” before making rash decisions about your portfolio.

Tax consequences of panic selling

The tax consequences depend on where you hold your investments. If they are in non-registered accounts (not RRSPs/TFSAs), your losing investments will be considered capital losses and as such, they can be deducted against any taxable capital gains earned for the year. At the very least, you can make your losing investments tax deductible on your tax return.

If they are held in tax-sheltered accounts such as RRSPs or TFSAs, your losing investments cannot be deducted since these funds are sheltered from taxation (tax-free in TFSAs, tax deferred in RRSPs). As advantageous as these accounts are when they’re gaining, they do nothing for you tax-wise when they’re losing money.

It’s too late! I’ve already panicked and sold for a loss. How can I still maximize my tax situation?

If you decide to dip your toes back into the market, and more specifically to buy back into the same companies from which you sold shares held in a non-registered account, make sure to avoid a superficial loss. To avoid this trap, you (or your spouse) must wait 30 days before buying back the same stock. Once the 30 days have passed, you can deduct your capital loss against any taxable capital gain for the year.

If you have no taxable capital gains in the year, you can also carry back your capital losses to the three prior years and deduct them retroactively, as long as you had taxable capital gains in those years.

Another way to optimize your losing investments from non-registered

accounts is to use the funds received to buy back into the market, but

this time in a tax-sheltered account like an RRSP or a TFSA. This allows

you to use the available cash to make a tax-deductible contribution (in

an RRSP), or to keep exempt from tax any future gains from these funds

(in a TFSA). We discussed a detailed procedure to do this in a previous UFile blog.

Want to learn more? Connect with us on Facebook and Twitter for news and updates on tax return and UFile online tax software. Visit Let's Talk Tax to get accurate answers to all your questions about your tax return.

Presented by UFile's tax expert

Presented by UFile's tax expert

Gerry Vittoratos

MTax

Categories

- Managing finances (33)

- Netfile (1)

- Saving taxes (54)

Last Blog posts

-

Separations

Apr 10, 2025

-

Employee vs self-employed

Apr 1, 2025

-

Five useful tax return credits

Mar 16, 2025

-

Tax Update 2024

Feb 11, 2025

-

Changes to rental income for short-term rentals

Jan 29, 2025

-

New Tax Rules for Capital Gains: What You Need to Know

Jan 16, 2025

-

CPP additional contributions

May 13, 2024

-

Death and taxes

May 1, 2024

-

Top family credits and benefits

Mar 25, 2024

-

Comparing the RRSP and the TFSA with the FHSA

Feb 21, 2024

More questions? We have answers.

Now with FREE TELEPHONE SUPPORT.

(Long distance charges may apply.)

Privacy Statement Contact Us

© 2025 Thomson Reuters/Tax & Accounting. All rights reserved.