Untitled Document

Please take note of the following important information regarding a known issue with CRA’s Auto-fill my return service.

Auto-fill my return CRA's service passing the wrong amount for variable "B" of the annual FHSA limit for 2023.

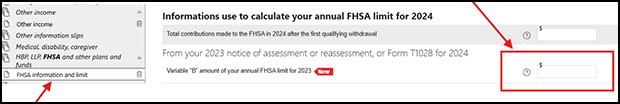

Why does UFile indicate an amount of $8,000 in the Interview section for “FHSA information and limit” for:

- “Information use to calculate your annual FHSA limit for 2024”

- “From your 2023 notice of assessment or reassessment, or Form T1028 for 2024”

- “Variable "B" amount of your annual FHSA limit for 2023”

When using CRA's Auto-fill my return service for 2024?

This is a technical issue with the CRA affecting the Auto-fill my return service, which may impact the calculation of your tax return and Schedule 15 – FHSA Contributions, Transfers and Activities.

In some cases*, the Auto-fill my return service is passing an incorrect amount of $8,000 instead of $0 for “Variable "B" amount of your annual FHSA limit for 2023.”

*This issue only impacts individuals who opened a FHSA account in 2023.

Steps to correct the situation:

- Delete the entry in the field for “Variable "B" amount of your annual FHSA limit for 2023.”

- Check the 2023 notice of assessment in the CRA's My Account to verify variable "B" and all amounts related to your FHSA.

- Enter the amount (if applicable) for “Variable "B" amount of your annual FHSA limit for 2023.”

As of March 14, 2025, the CRA has indicated that they plan to deploy a fix during the week of March 17.

Important: The CRA has confirmed that the issue with FHSA amounts within the Auto-fill my return service has been resolved as of March 17, 2025.